Medical Equipment Depreciation Rate Sars . 1% or 2% of total employee remuneration) are treated as income and taxed. Medical expenses in excess of the maximum allowable amount (i.e. Sars recently issued interpretation note no. Unless indicated otherwise, the latest issue of these documents should be consulted.

from www.chegg.com

Sars recently issued interpretation note no. Unless indicated otherwise, the latest issue of these documents should be consulted. 1% or 2% of total employee remuneration) are treated as income and taxed. Medical expenses in excess of the maximum allowable amount (i.e.

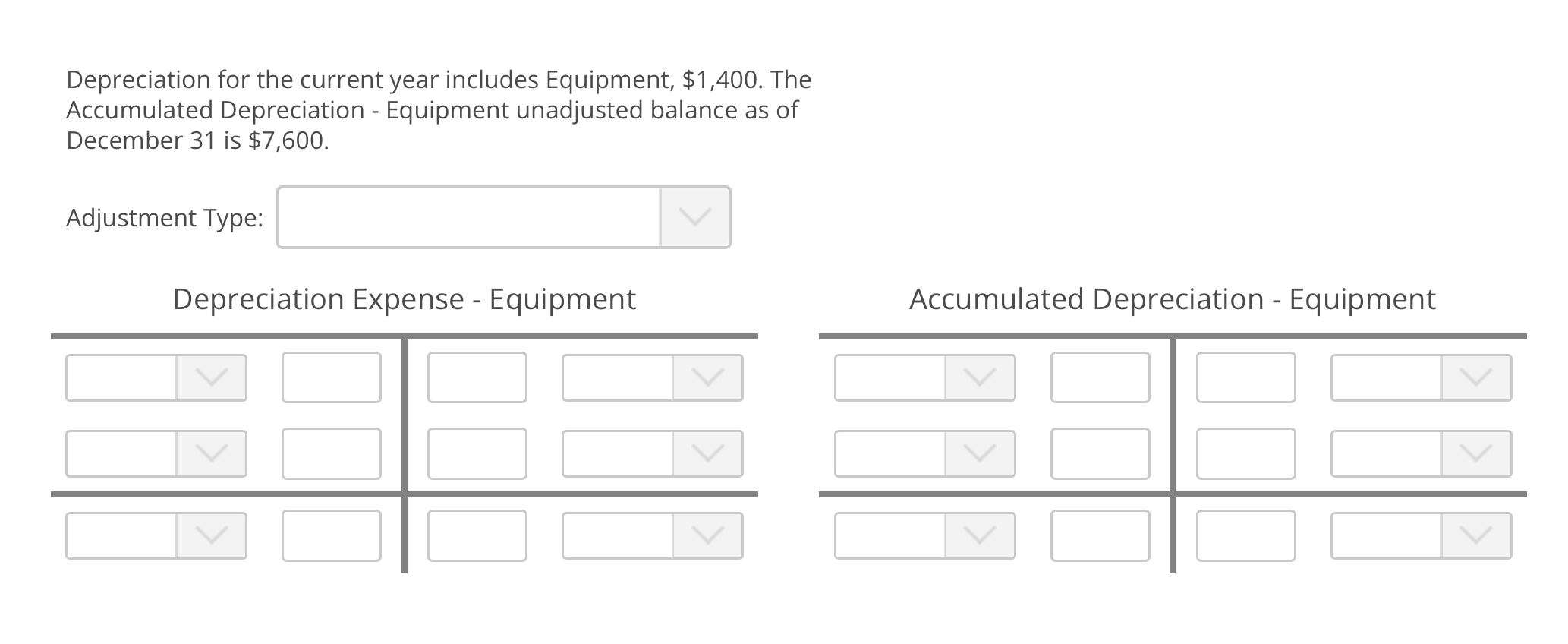

Solved Depreciation for the current year includes Equipment,

Medical Equipment Depreciation Rate Sars Medical expenses in excess of the maximum allowable amount (i.e. Sars recently issued interpretation note no. 1% or 2% of total employee remuneration) are treated as income and taxed. Medical expenses in excess of the maximum allowable amount (i.e. Unless indicated otherwise, the latest issue of these documents should be consulted.

From www.slideteam.net

Calculation Of Depreciation On Fixed Assets Depreciation Expense Ppt Medical Equipment Depreciation Rate Sars Medical expenses in excess of the maximum allowable amount (i.e. Sars recently issued interpretation note no. 1% or 2% of total employee remuneration) are treated as income and taxed. Unless indicated otherwise, the latest issue of these documents should be consulted. Medical Equipment Depreciation Rate Sars.

From www.loganconsulting.com

How D365 can Help Track Medical Equipment Depreciation Medical Equipment Depreciation Rate Sars Medical expenses in excess of the maximum allowable amount (i.e. 1% or 2% of total employee remuneration) are treated as income and taxed. Sars recently issued interpretation note no. Unless indicated otherwise, the latest issue of these documents should be consulted. Medical Equipment Depreciation Rate Sars.

From elchoroukhost.net

Us Gaap Depreciation Useful Life Table Elcho Table Medical Equipment Depreciation Rate Sars Sars recently issued interpretation note no. Medical expenses in excess of the maximum allowable amount (i.e. Unless indicated otherwise, the latest issue of these documents should be consulted. 1% or 2% of total employee remuneration) are treated as income and taxed. Medical Equipment Depreciation Rate Sars.

From studylib.net

Depreciation Rates Medical Equipment Depreciation Rate Sars Unless indicated otherwise, the latest issue of these documents should be consulted. Medical expenses in excess of the maximum allowable amount (i.e. Sars recently issued interpretation note no. 1% or 2% of total employee remuneration) are treated as income and taxed. Medical Equipment Depreciation Rate Sars.

From fitsmallbusiness.com

Rental Property Depreciation How It Works, How to Calculate & More Medical Equipment Depreciation Rate Sars Unless indicated otherwise, the latest issue of these documents should be consulted. 1% or 2% of total employee remuneration) are treated as income and taxed. Medical expenses in excess of the maximum allowable amount (i.e. Sars recently issued interpretation note no. Medical Equipment Depreciation Rate Sars.

From brokeasshome.com

Irs Depreciation Tables 2018 Medical Equipment Depreciation Rate Sars Medical expenses in excess of the maximum allowable amount (i.e. Sars recently issued interpretation note no. 1% or 2% of total employee remuneration) are treated as income and taxed. Unless indicated otherwise, the latest issue of these documents should be consulted. Medical Equipment Depreciation Rate Sars.

From www.caselle.com

Depreciation Schedule Medical Equipment Depreciation Rate Sars Sars recently issued interpretation note no. Medical expenses in excess of the maximum allowable amount (i.e. 1% or 2% of total employee remuneration) are treated as income and taxed. Unless indicated otherwise, the latest issue of these documents should be consulted. Medical Equipment Depreciation Rate Sars.

From arpanbohra.co.in

Depreciation Rate Chart As per Companies Act 2013 Arpan Bohra & Co Medical Equipment Depreciation Rate Sars Sars recently issued interpretation note no. 1% or 2% of total employee remuneration) are treated as income and taxed. Medical expenses in excess of the maximum allowable amount (i.e. Unless indicated otherwise, the latest issue of these documents should be consulted. Medical Equipment Depreciation Rate Sars.

From atotaxrates.info

ATO depreciation rates and depreciation schedules AtoTaxRates.info Medical Equipment Depreciation Rate Sars Medical expenses in excess of the maximum allowable amount (i.e. Sars recently issued interpretation note no. 1% or 2% of total employee remuneration) are treated as income and taxed. Unless indicated otherwise, the latest issue of these documents should be consulted. Medical Equipment Depreciation Rate Sars.

From www.primedeq.com

Medical Equipment Depreciation PrimedeqBlog Medical Equipment Depreciation Rate Sars Unless indicated otherwise, the latest issue of these documents should be consulted. 1% or 2% of total employee remuneration) are treated as income and taxed. Medical expenses in excess of the maximum allowable amount (i.e. Sars recently issued interpretation note no. Medical Equipment Depreciation Rate Sars.

From www.bmtqs.com.au

Fixtures & Fittings Depreciation Rate BMT Insider Medical Equipment Depreciation Rate Sars Sars recently issued interpretation note no. Medical expenses in excess of the maximum allowable amount (i.e. Unless indicated otherwise, the latest issue of these documents should be consulted. 1% or 2% of total employee remuneration) are treated as income and taxed. Medical Equipment Depreciation Rate Sars.

From limblecmms.com

What is Equipment Depreciation? Limble CMMS Medical Equipment Depreciation Rate Sars Sars recently issued interpretation note no. Medical expenses in excess of the maximum allowable amount (i.e. Unless indicated otherwise, the latest issue of these documents should be consulted. 1% or 2% of total employee remuneration) are treated as income and taxed. Medical Equipment Depreciation Rate Sars.

From www.chegg.com

Solved Depreciation for the current year includes Equipment, Medical Equipment Depreciation Rate Sars Medical expenses in excess of the maximum allowable amount (i.e. 1% or 2% of total employee remuneration) are treated as income and taxed. Sars recently issued interpretation note no. Unless indicated otherwise, the latest issue of these documents should be consulted. Medical Equipment Depreciation Rate Sars.

From arpanbohra.co.in

Depreciation Rate Chart As per Companies Act 2013 Arpan Bohra & Co Medical Equipment Depreciation Rate Sars Medical expenses in excess of the maximum allowable amount (i.e. Sars recently issued interpretation note no. Unless indicated otherwise, the latest issue of these documents should be consulted. 1% or 2% of total employee remuneration) are treated as income and taxed. Medical Equipment Depreciation Rate Sars.

From sailsojourn.com

8 ways to calculate depreciation in Excel (2024) Medical Equipment Depreciation Rate Sars Sars recently issued interpretation note no. 1% or 2% of total employee remuneration) are treated as income and taxed. Medical expenses in excess of the maximum allowable amount (i.e. Unless indicated otherwise, the latest issue of these documents should be consulted. Medical Equipment Depreciation Rate Sars.

From www.youtube.com

SARS eFiling How to submit your ITR12 YouTube Medical Equipment Depreciation Rate Sars Unless indicated otherwise, the latest issue of these documents should be consulted. Sars recently issued interpretation note no. Medical expenses in excess of the maximum allowable amount (i.e. 1% or 2% of total employee remuneration) are treated as income and taxed. Medical Equipment Depreciation Rate Sars.

From www.babelsoftco.com

Equipment Depreciation Report Babelsoftco Medical Equipment Depreciation Rate Sars Unless indicated otherwise, the latest issue of these documents should be consulted. Sars recently issued interpretation note no. Medical expenses in excess of the maximum allowable amount (i.e. 1% or 2% of total employee remuneration) are treated as income and taxed. Medical Equipment Depreciation Rate Sars.

From www.scribd.com

Depreciation Rates Companies Act.pdf Engines Taxes Medical Equipment Depreciation Rate Sars Sars recently issued interpretation note no. 1% or 2% of total employee remuneration) are treated as income and taxed. Medical expenses in excess of the maximum allowable amount (i.e. Unless indicated otherwise, the latest issue of these documents should be consulted. Medical Equipment Depreciation Rate Sars.